NFE - Gold and Silver Ounce analysis (Exclusive)

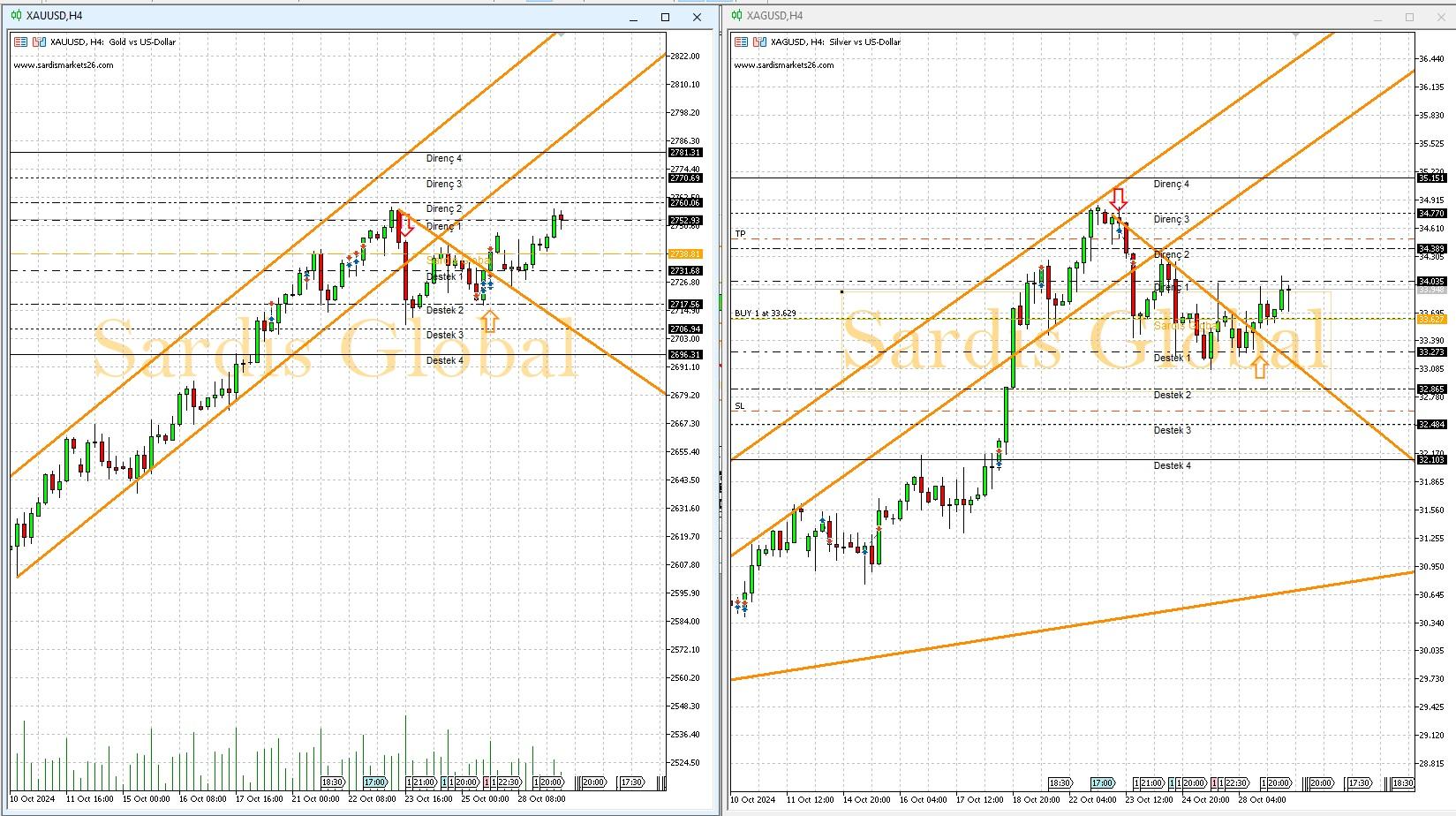

Despite a lower expectation compared to previous data for ADP and Non-Farm Payroll reports, Silver, which has lagged behind in correlation, might experience upward pricing. This aligns with previous analyses grounded in fundamentals. It is anticipated that pullbacks in both commodities, where selling pressure is absent, could be limited due to geopolitical risks. In case there is a pullback in Silver due to Non-Farm Payroll data affecting Gold pricing, support levels at 33.627, 33.273, and 32.865 are considered suitable for buying positions. Additionally, although a decrease in gold demand in China is not significant, many central banks have reached historic highs in gold stocks. There is substantial evidence from both fundamental and technical perspectives that Silver could align with Gold pricing and continue its upward trend. In particular, it is anticipated that upward movements in Silver could be more pronounced in 2025.

Support :

Resistance :