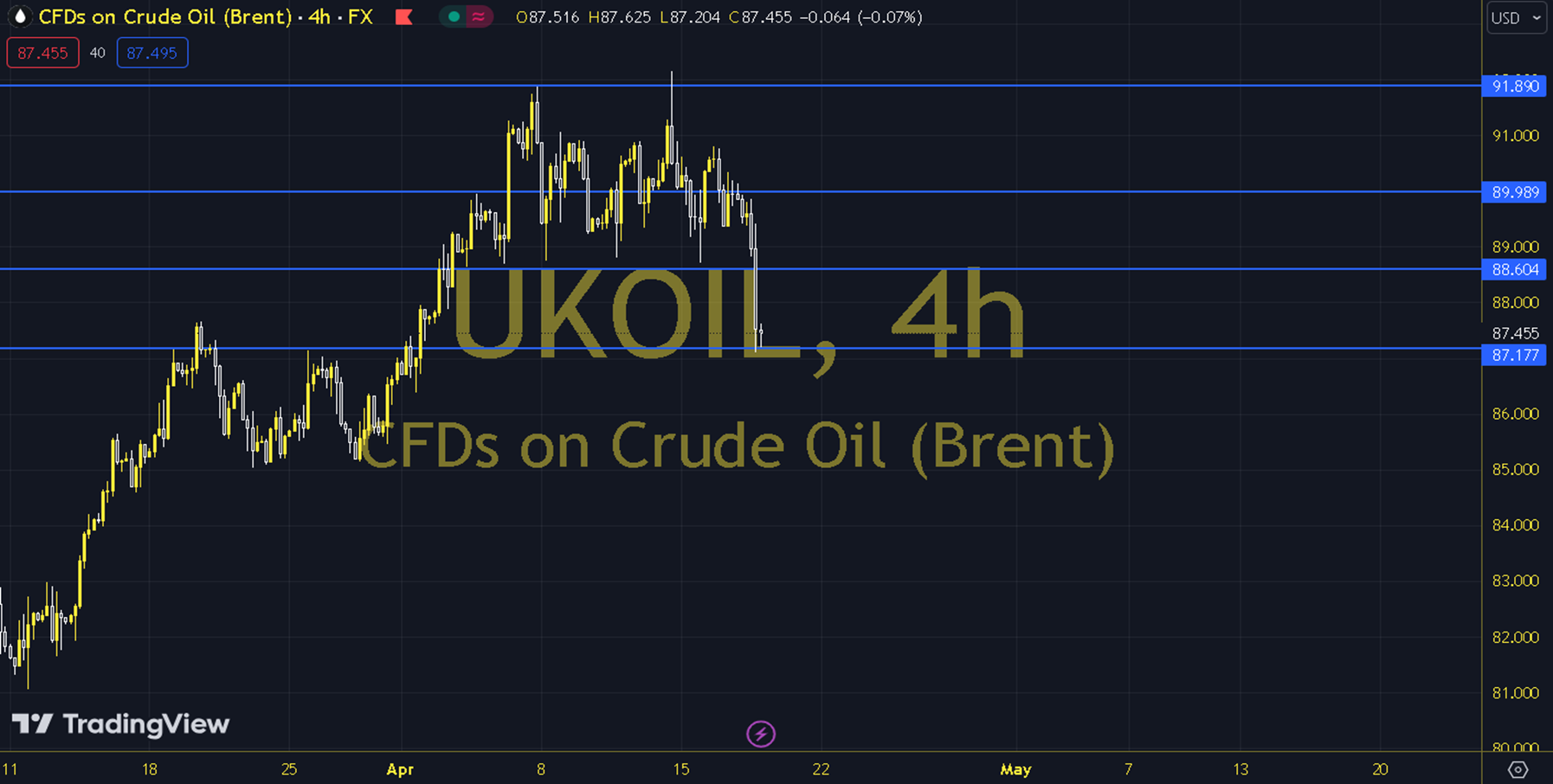

BRENT

Oil prices have been under pressure amid signs that U.S. oil supply remains strong and demand concerns are rising. Energy Information Administration data showed that U.S. crude oil inventories rose by 2.735 million barrels last week, for the fourth week in a row, exceeding market expectations for a 1.6 million barrel increase. The course of U.S. stock markets can be monitored throughout the day. As long as pricing remains below the 88.50-89.00 resistance, a downward trend may be at the forefront. In possible declines, the 87.00 and 86.50 levels may be targeted. In possible recoveries, as long as the 88.50-89.00 resistance remains current, there may be potential for new declines. Therefore, it may be necessary to see a course above 89.00 and 4-hour closings for the continuation of the upward desire. In this case, the 89.50 and 90.00 levels may be on the agenda. Support: 87.00-86.50 Resistance: 88.00-88.50