WTI

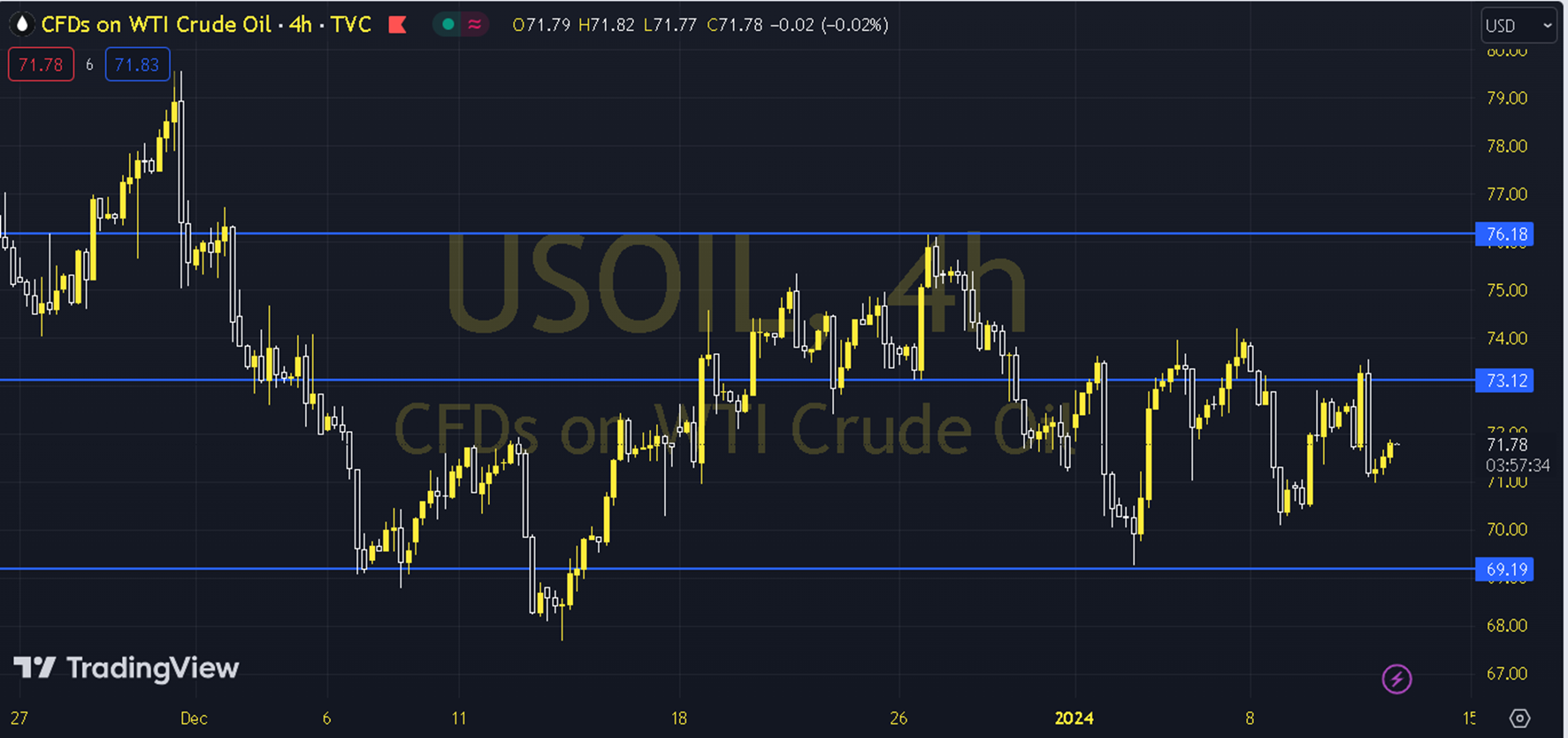

Despite the American Petroleum Institute's announcement of a 5.2 million barrel decrease in stocks, the US Energy Information Administration's surprising announcement of a 1.3 million barrel increase caused us to see a pullback in oil prices. Headlines that could potentially push oil up, such as Middle East tensions and OPEC cuts, are still current. The course of European and US stock markets and US inflation data can be followed during the day. As long as pricing remains below the 72.00 - 72.50 resistance in the upcoming period, an upward and downward outlook may be at the forefront. In possible declines, 71.00 and 70.50 levels can be targeted. In possible recoveries, the attitude of the 72.00 - 72.50 resistance can be followed. Breaking this resistance and 4-hour closings in the region may bring the 73.00 and 73.50 levels to the agenda. Support: 71.00 Resistance: 72.50