Fed left interest rates unchanged, signaled interest rate cut in 2024

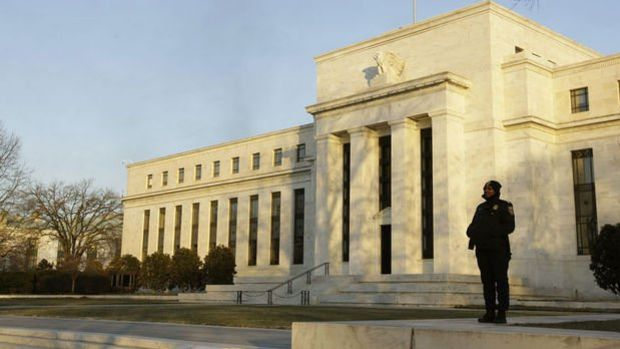

The US Federal Reserve (Fed) kept the policy rate unchanged at its highest level in 22 years, as expected, at its last meeting of the year. Thus, the bank kept the rate unchanged for 3 consecutive meetings. The Fed predicted a 75 basis point rate cut in 2024. While Fed Chair Jerome Powell stated that the possibility of an additional rate hike was not completely off the table, he stated that the timing of the rate cut was being discussed. The Fed kept the policy rate unchanged at its December meeting, keeping it between 5.25-5.50 percent. The decision was taken unanimously. The expectation was that interest rates would not change. The bank predicted 3 rate cuts for next year. The Fed revised its growth forecast upwards for this year and downwards for next year. The 2023 forecast was revised from 2.1 percent to 2.6 percent, and from 1.5 percent to 1.4 percent for 2024. The 2025 growth forecast remained unchanged at 1.8 percent, while the 2026 forecast was raised from 1.8 percent to 1.9 percent. 3 interest rate cuts predicted in 2024 The Fed predicted 3 interest rate cuts in 2024 in dot plots known as dot plots. Fed officials also predicted interest rate cuts in 2025 and 2026. The Fed lowered its forecast for the federal funds rate from 5.6 percent to 5.4 percent for the end of this year. The forecast for 2024 was lowered from 5.1 percent to 4.6 percent, and for 2025 from 3.9 percent to 3.6 percent. The 2023 inflation expectation was lowered from 3.3 percent to 2.8 percent, and the 2024 expectation was lowered from 2.5 percent to 2.4 percent. The core inflation expectation for this year was lowered to 3.2 percent, and the expectation for 2024 was lowered to 2.4 percent. The unemployment rate estimates were kept at 3.8 percent for this year, 4.1 percent for next year, and 4.1 percent for 2025. The unemployment rate forecast for 2026 was raised from 4 percent to 4.1 percent. “Inflation slowed but remained high” The statement stated that the latest indicators indicate that the strong pace of growth in economic activity slowed in the third quarter. It was noted in the statement that employment gains have slowed since the beginning of the year but remained strong, and that the unemployment rate remained low. The statement stated that inflation slowed throughout the year but remained high. Messages from Powell: Interest rate hikes are not off the table Chairman Jerome Powell stated in the press conference held after the interest rate decision that the path for the future is uncertain and the full effects of the tightening have not yet been seen. Powell stated that inflation has slowed but is still high. Powell stated that the possibility of additional rate hikes is not completely off the table. He said the timing of the rate cut was under discussion. The highlights of Powell’s speech are as follows; “Many economic indicators are returning to normal. We think the policy rate is probably at or near the peak in the tightening cycle. It will take time for us to reach our inflation target of 2%. We are carefully monitoring the risks that high inflation may create. Our cautious stance will continue. There may be further tightening if necessary. It is too early to declare victory, the economy could take an unexpected turn.” The Fed left interest rates unchanged at its November meeting, and Chairman Jerome Powell had given the message that they would proceed cautiously in monetary policy. The Fed had implemented 11 rate hikes since March 2022 as part of the fight against high inflation, increasing interest rates by a total of 525 basis points.