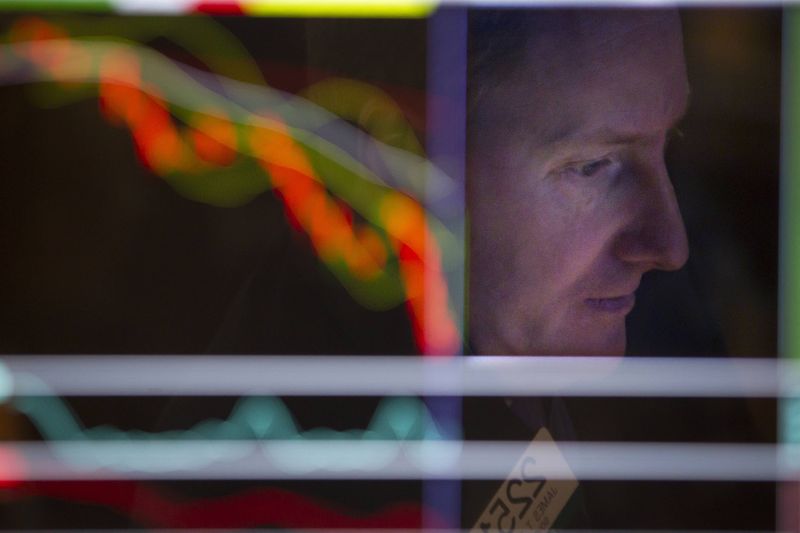

Headline: Gulf Markets Decline Amid Escalating Regional Tensions

In early trading today, most major stock markets in the Gulf region saw declines due to escalating geopolitical tensions. Markets reacted to news that Israel confirmed the killing of Hashim Safieddine, a top figure in Hezbollah and considered a successor to the group's former leader Hassan Nasrallah, who was killed last month.

Saudi Arabia's benchmark index recorded a 0.4% drop, influenced by a 0.5% decrease in shares of aluminum products manufacturer Al Taiseer Group and a 0.6% fall in Al-Rajhi Bank stocks. Additionally, shares of Banque Saudi Fransi fell by 1% after the bank reported a decline in quarterly net profit.

The International Monetary Fund (IMF) has revised Saudi Arabia's GDP growth forecast for 2024 down to 1.5%, expecting growth to rise to 4.6% the following year. This update was included in the IMF's latest World Economic Outlook Report released on Tuesday.

The Abu Dhabi index also fell by 0.2%. Market sentiment was affected by shifting expectations about the pace and scale of interest rate cuts by the Federal Reserve. Traders now anticipate that the U.S. central bank will take a more cautious approach to easing.

Monetary policy in the Gulf Cooperation Council (GCC) countries, which includes the United Arab Emirates, is typically closely aligned with the Fed's decisions due to the pegging of regional currencies to the U.S. dollar.

Despite the generally downward trend, Dubai's main stock index bucked the trend, gaining 0.3%. This rise was attributed to a 1.4% increase in shares of toll operator Salik Company.

The Qatar index fell by 0.3%, with a notable 0.3% decline in shares of Qatar National Bank, the Gulf's largest lender.